Luxury Watch Market: Not Great, Not Terrible

Has the resurgence of Bitcoin boosted the price of luxury watches?

The price of Bitcoin has returned to near its all time high. As of this writing, it is trading at $67,090, not far from its all time high of $73,687.

Taking a look at the Chrono24 ‘Chronopulse’, we see nothing of note, but not a decline.

Reports Coinpage:

Notable price movements have been observed in sought-after models such as the Audemars Piguet ‘Jumbo’ Royal Oak and the Patek Nautilus 5711. Of particular interest is the Rolex GMT with a red and blue ceramic bezel, affectionately known as the ‘Pepsi’, which has experienced a commendable price uptick of approximately 1.9%. Market analysts are closely monitoring the anticipated market response to new watch releases slated for the Watches and Wonders event, as these unveilings are poised to exert considerable influence on prices.

Despite the overall stability, fluctuations persist, with certain models witnessing declines while others maintain or even increase in value. Against this backdrop, Bitcoin’s recent rebound has significantly impacted investor sentiment, with its price surging by 3.23% to $68,462.46 at the time of writing on Monday, March 18. However, a concurrent slump of 9.80% in Bitcoin’s trading volume over the last 24 hours, juxtaposed with its sustained market cap of $1.34 trillion, underscores the enduring significance and potential influence of cryptocurrencies on luxury watch prices.

If you had been eyeing your heavier pieces with trepidation, wondering where the floor might be, there seems to be a a line under it.

Taking, at random, and for no particular reason (cough cough) the two-tone GMT Master II ‘Root Beer’, while still down substantially from its high, it doesn’t seem to be falling much below 18 grand.

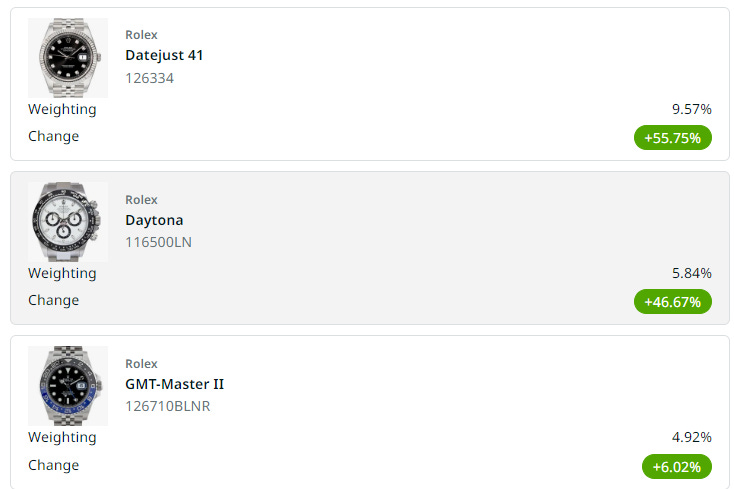

The real item of note would be the performance of specific hot models such as the Rolex Daytona.

Will we return to the 2021 days of mania? Probably not. But we’re not down for the count.